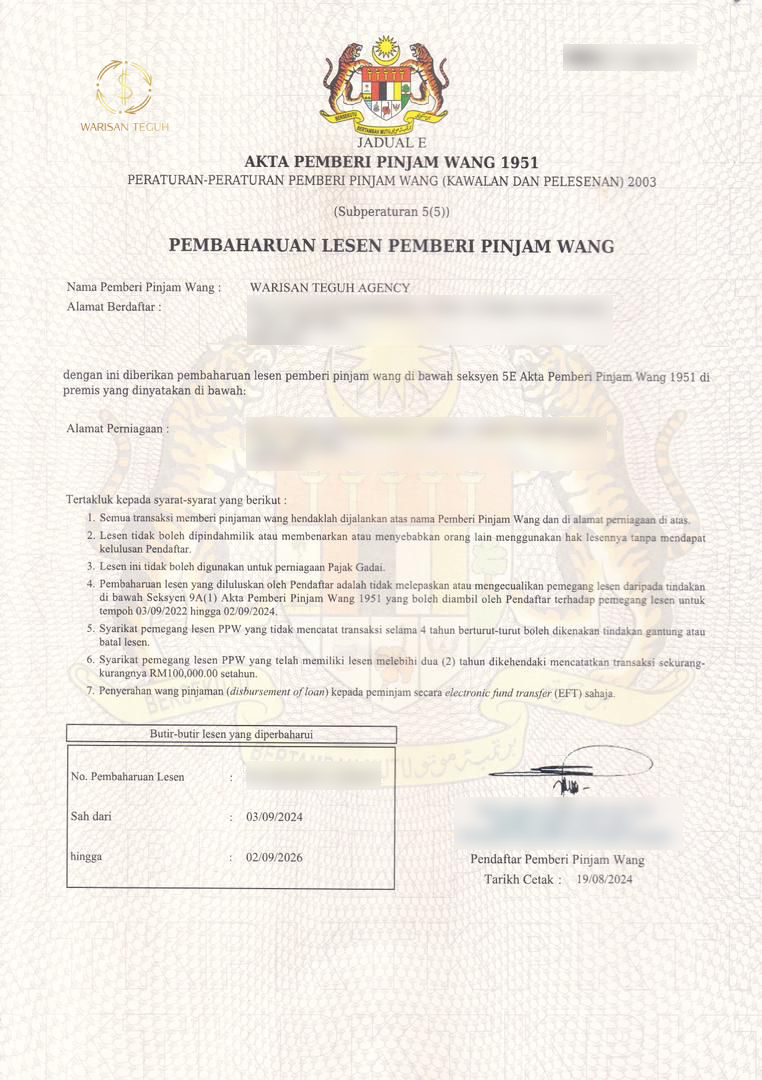

Licensed & Trusted Loan Services in Malaysia

We are a fully licensed loan agency committed to helping individuals and businesses across

Malaysia access fast, secure, and transparent financing solutions.

Whether it's personal, business, or emergency funding — our team is dedicated to guiding you every step

of the way. We offer flexible repayment plans, same-day approvals, and full confidentiality with every

application.

Professional Loan Consultants

Our experienced team provides personalized advice to help you choose the right loan with

confidence and peace of mind.

Fast & Transparent Process

No hidden charges, no long waits. We prioritize efficiency and clarity to make the process smooth

and stress-free.

Explore Our Loan Services